The CISO knew he had a data leak but he didn’t know how big. He suspected data masking was the solution but he couldn’t make a business case for the investment. Those were the problems the RiskLens Professional Services team set out to solve for this client. Here's the story:

Like many of the other customers that we work with, this team had limited experience analyzing risk scenarios. They were thinking of risk basically as a scary event, and part of the job when we’re onsite is to draw the information out so we could quantify their risk.

As part of the scoping process, we first identified what assets were of most concern from a data leak perspective—in this case, data repositories and SharePoint holding personally identifiable information (PII) and contractual information from clients.

Then we looked to identify the threat community. Their main concern going in was malicious external actors causing an exfiltration of information.

Yet when we asked a few key questions, we quickly came to understand that the most likely concern was insiders either accidentally sending out emails that contain PII or stealing contractual information, particularly as they left the company for other jobs. But the CISO only had a few confirmed cases of data leakage, not a lot of hard evidence to project from.

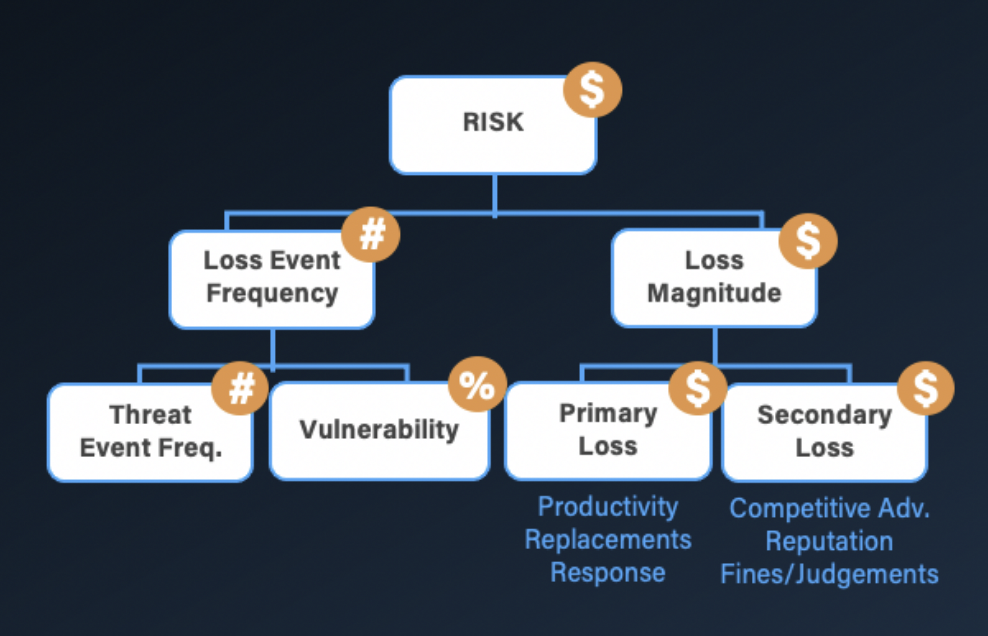

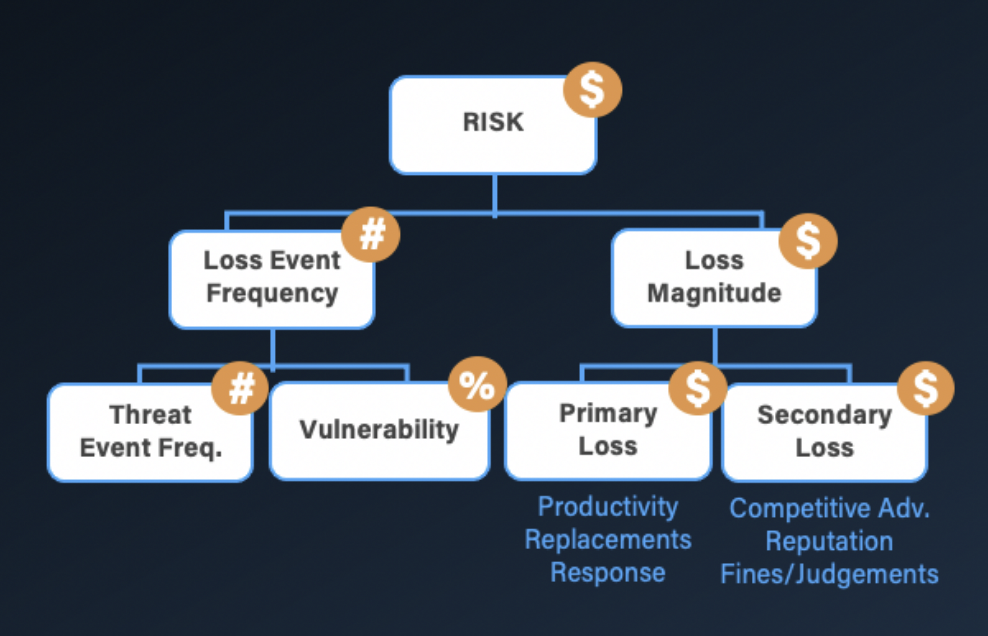

The FAIR Model

We also learned through our data gathering that if information does get sent to the wrong person, there were no real procedures in place to notify information security, or DLP solution.

Using the guided workshop feature of the RiskLens platform, we created a risk scenario and filled in the appropriate data using the platform's Data Helpers and Loss Tables, with industry-specific data curated by the RiskLens Data Science team.

Included in our data was an estimate on Secondary Loss Event Frequency in other words, a Loss Event that affects their customers, regulators, business partners, etc. In the past, they’d had limited Secondary Loss Events, mainly because the company had reached out to clients and assuaged them – but they recognized they couldn’t count on that working forever.

On the right side of the chart, we could estimate the magnitude of their potential losses from data leakage--lost productivity, response time for the security team, fines and judgements, loss of reputation with customers—from the Loss Tables and Data Helpers.

With the frequency and magnitude in hand, we could show the CISO his risk, or the Annualized Loss Exposure in FAIR terminology. We always show that as a distribution to account for the variance in exposure when modeling future events:

Example of a range of Annualized Loss Exposure in a RiskLens analysis report

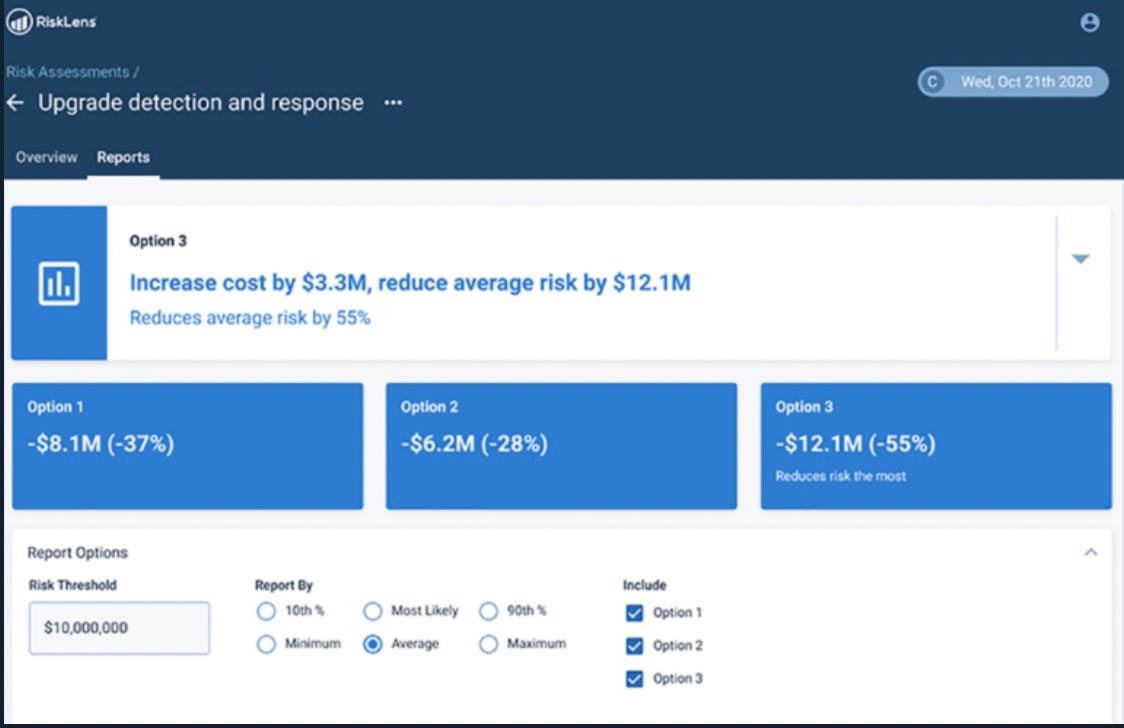

Next, with the Risk Treatment function of the platform, we modeled their future state if they put data masking in place. So this means that their staff could not accidentally send an email containing sensitive customer data to the wrong source, or accidentally lose a USB stick containing sensitive customer data.

Example of a Risk Treatment analysis report

There was a tremendous reduction in risk--in fact, releases would almost never occur–- going from an average annualized loss exposure of $2 million a year to $61,000 on average.

So, at the end of the day, we were able to give the CISO a solid understanding of his forecasted data leak loss exposure and a cost/benefit analysis for him to go forward with confidence to have a ROI discussion with any of his colleagues about the merits of implementing a data masking initiative.

And another important deliverable: We showed the CISO’s team how they could run scenarios going forward with the RiskLens application, to keep on quantifying risk, as other investment decisions came up.