Cyber Risk Management Solutions

RiskLens partners with large enterprises and government organizations so they can make risk informed decisions, optimize their cybersecurity investments, and address regulatory and privacy requirements by scaling their quantitative cyber risk management programs.

Solutions by Topic

- NIST CSF & FAIR

- Cybersecurity Investments & Decisions

- Digital Transformation

- Regulatory & Privacy

NIST CSF & FAIR™

RiskLens helps put your NIST CSF work in the context of the actual cyber risk that your organization is facing to determine which NIST CSF activities are directly relevant to your most significant loss event scenarios. Focus your efforts on those, instead of spreading your scarce resources on activities that matter less.

Unlock NIST CSF & FAIR™ Solutions

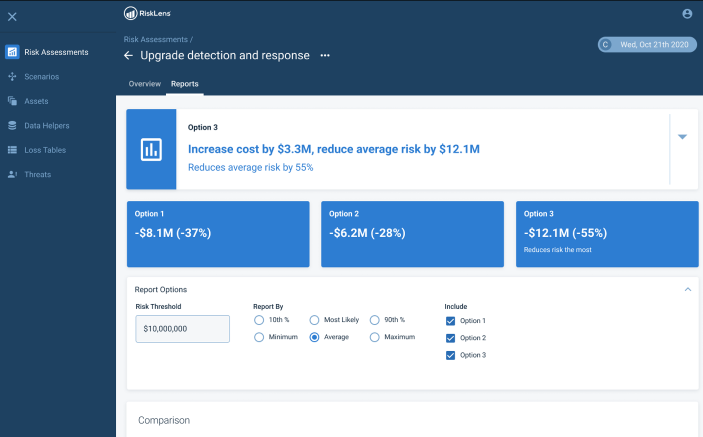

Cybersecurity Investments & Decisions

Cybersecurity teams must navigate the tradeoffs on security investments by determining which controls are worth the investment. These are complex decisions that need to be based on cost-effectiveness, executed with speed and communicated in business terms. Ultimately, teams can optimize cybersecurity spending by identifying which options provide the largest cost reductions while minimizing the impact to risk exposure.

Unlock Cybersecurity Investment & Decision Solutions

Digital Transformation

Although digital trends are accelerating new business opportunities, they also introduce new risks. To make the right business decisions and select the right security architecture, it is critical for organizations to assess the cyber risks associated with these new digital initiatives and quantify their financial impacts on the business.

Unlock Digital Transformation Solutions

Regulatory & Privacy

Regulators call for top risk assessments, a definition for risk appetite and a demonstration of the efficacy of their program in driving risk down. Regulators are asking companies to demonstrate the validity of the risk models they use and it has become increasingly challenging for these companies to defend their models. As a result, Regulators are increasingly demanding formal risk-based approaches using defensible models like FAIR™, rather than relying solely on technical checklists.

Unlock Regulatory & Privacy SolutionsSolutions by Role

- Board & Business Executives

- CISOs

- CIROs

- Cyber Risk Analysts

Board & Business Executives

With RiskLens, Board & Business Executives are finally able to understand the potential financial impact of top cyber risks as the organization is deploying digital transformation initiatives and optimizing its cybersecurity spend. Assessing risk in financial terms helps to explicitly define acceptable risk tolerance levels and approve clear and actionable risk appetite objectives. RiskLens can also aid in assessing the adequacy of cybersecurity measures and budgets in the face of the actual risks the company faces.

Unlock Solutions for Board & Business Executives

CISOs

The expectations for CISOs have changed. Merely managing against technical compliance or given maturity models is insufficient to manage cyber risk from the business perspective. CISOs are now expected to act as Business Executives and to become true risk managers that know how to prioritize and rightsize their security initiatives based on business impact. Leverage RiskLens to evaluate which security initiatives are the most effective in reducing risk, to measure cost-benefit, justify budget requests and show the effectiveness of your security program over time.

Unlock Solutions for CISOs

CIROs

Cyber risk management programs without formal risk models that rely on qualitative measurements cannot be used for sound decision making. The emergence of the standard FAIR risk model is allowing CIROs in large enterprises and government organizations to build highly effective cyber risk management programs. These programs enable risk to be assessed and communicated from the business perspective, in financial terms, so the business and the board can make risk-informed and cost-effective decisions.

Unlock Solutions for CIROs

Cyber Risk Analysts

In many organizations, Risk Analysts do not have an effective model for analyzing cyber risk. Risk Analysis is often manual and error-prone as it relies on highly subjective qualitative assessments. RiskLens allows risk analysts to assess and report on cyber risk across the enterprise in a consistent and defensible way, leveraging the standard FAIR risk model. Results are expressed in financial terms and can be easily aggregated to provide enterprise-level views of risk.

Unlock Solutions for Cyber Risk AnalystsSolutions by Industry

- Financial Services

- Healthcare

- U.S. Federal Government

- Technology & Digital Services

Financial Services

Digitilization of the banking and financial services sector has unleashed tremendous productivity improvements and convenience for consumers, but has also exposed it to an ever increasing number of cyber threats to a point where cyber risk has become a top business priority. The business and the board now demand improved visibility into the business impact of cyber risks, well beyond the traditional qualitative "red, yellow, green" risk ratings that do not measure cyber risk with the same rigor as credit or market Value at Risk (VaR) models. In addition, regulators are mandating more formal assessments and disclosures of cyber risk. RiskLens can help financial services organizations build quantitative cyber risk management programs based on the FAIR VaR model that helps them articulate and manage cyber risk in financial terms.

Unlock Financial Services Solutions

Healthcare

Healthcare providers are experiencing a perfect storm of increased cyber attacks, more demanding data privacy regulations and mounting financial pressures. Ransomware attacks in particular have revealed the serious deficiencies in IT and cybersecruity practices. Healthcare organizations must build quantitative cyber risk management programs that help them identify their top cybersecurity risks, prioritize and justify their risk mitigation initiatives, and meet increasingly stringent cybersecurity and privacy regulations. RiskLens supports organizations in the Healthcare industry with cyber risk management solutions that allow them to assess and manage cyber risk based on financial impact and adhere to HIPAA guidance on risk assessments.

Unlock Healthcare Solutions

U.S. Federal Government

Agencies use RiskLens cyber risk quantification to not just comply with federal directives on risk management, but to guide security initiatives based on cost-benefit analysis. RiskLens accelerates cyber risk analysis, making data collection, quantitative analysis and reporting faster, easier and scalable. With NIST standards at the heart of federal cybersecurity compliance activities, you can be confident that your risk management program will be in line with policies, now and going forward.

Unlock U.S. Federal Government Solutions

Technology & Digital Services

In a sector where speed doubles, costs halve and business models constantly shift, cybersecurity needs to be tightly aligned with ever changing business needs. Analyzing cyber risk in financial terms, showing potential loss exposure in dollars, opens the way to align cybersecurity needs with business strategy so CISOs can make well-informed and well-timed decisions. With RiskLens, CISOs present to the board and internal stakeholders clear, easy-to-read reports in detailed, financial metrics that demonstrate the risk buy-down of security initiatives and establish the strategic value of security to the organization.

Unlock Technology & Digital Services SolutionsA Look Into the RiskLens Platform

Purpose built on the FAIR standard, the RiskLens platform simplifies, accelerates and scales the application of FAIR, enabling agile cyber risk management.

Discover Our Platform

An Executive's Guide to Cyber Risk Economics

Three time CISO, and creator of the FAIR standard, Jack Jones provides a high-level introduction to managing cyber risk from the business perspective. Learn how FAIR powers cost-effective analysis for security initiatives.

Download the Guide