Identifying top cyber risk scenarios is one of the most important and difficult elements of assessing risk. Companies often don’t properly prioritize the risks they face and end up flying blind on planning cybersecurity defenses.

Identifying top cyber risk scenarios is one of the most important and difficult elements of assessing risk. Companies often don’t properly prioritize the risks they face and end up flying blind on planning cybersecurity defenses.

With a reliable way to quantitatively rank top cybersecurity risks based on probable loss exposure in dollars, organizations can

- Break through the communication barrier between IT security and the rest of the business

- Confidently enable reporting on risk to senior management and the board

- Prioritize cyber risk mitigations based on business impact

- Determine the ROI of cybersecurity risk management programs

But if you’re new to quantitative risk management, where do you start?

RiskLens is the creator of FAIR™ (Factor Analysis of Information Risk), a disciplined model for applying critical thinking to risk measurement and a standard recognized by the National Institute of Standards and Technology (NIST).

We add curated, industry cyber risk data and data specific to the client. Then we run an analytics engine on the RiskLens platform that yields quantified results on probable risk exposure much like a financial analysis.

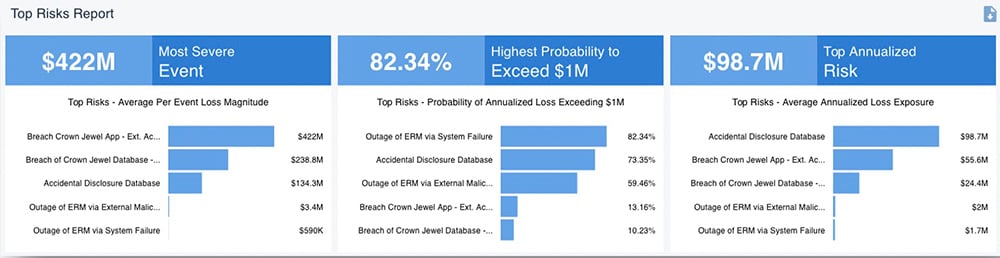

Top risks report from the RiskLens platform

FAIR is not just a model, it’s also a mindset that’s far advanced beyond many typical risk “analysis” methods that rely on educated guesses to assign high/medium/low rankings.

To start your thinking about risk in a new way, we put together this mini-guide of posts from the RiskLens blog:

Do Your Top 10 Risks Align with Reality?

For many organizations, the current process for establishing a list of top 10 risks is some combination of:

- Taking what they experienced that they know is bad yet still exists.

- Combining it with the latest scary headlines.

If that sounds familiar, read this high-level critique of the status-quo in cyber risk assessment.

In a Top-10 Risks Analysis, Get These 2 Factors Right

This post about a risk assessment at a bank explains a ground truth of FAIR analysis -- “risk = the probable frequency and probable magnitude of future loss” – with an example of how risk managers can misjudge high impact loss events that occur at low frequency and are therefore low risk – and conversely misjudge low impact but high frequency events that add up to a high risk.

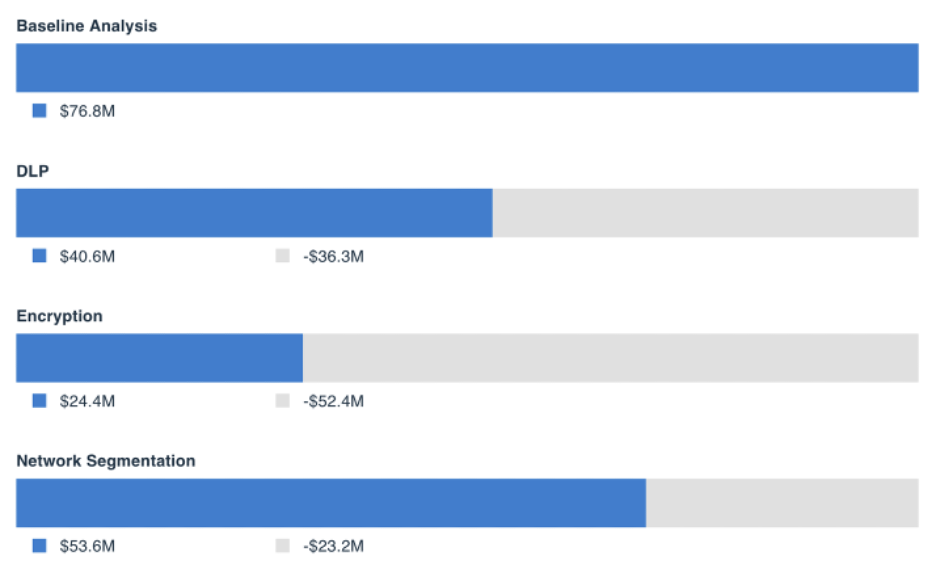

3 Steps to Prioritizing Controls Investments with RiskLens

A high-level description of how RiskLens creates a top risk assessment for an organization, followed by detailed analysis of the highest risks, then risk treatment analysis to identify the most cost-effective way to mitigate a top risk.

Risk treatment analysis on the RiskLens platform

5 Uses for a Top Cyber Risks Analysis

This post covers some of the most popular uses of top risk analyses, such as reporting to the board or regulators, responding to policy exception requests, audit findings or compliance gaps, and identifying lines of business with greatest loss exposure.

See the output of RiskLens top-risk reporting in a format that’s easily digested by non-technical stakeholders on the board or in senior management – a colorful dashboard organized around risk themes of most relevance to the organization. With APIs, the dashboard updates with the latest analyses pulled from the RiskLens platform.