Watch this webinar for a video demonstration of the seamless integration of the RiskLens platform with a GRC, IRM or other system of record via RiskLens API, with the goal of driving efficiency, reducing redundancy, and increasing the strategic value of risk management platforms with cyber risk quantification (CRQ).

Watch this webinar for a video demonstration of the seamless integration of the RiskLens platform with a GRC, IRM or other system of record via RiskLens API, with the goal of driving efficiency, reducing redundancy, and increasing the strategic value of risk management platforms with cyber risk quantification (CRQ).

As you’ll see in a live demo, RiskLens clients can

- Create a risk item in their risk register

- With one click, push the item via RiskLens API to the RiskLens platform

- Perform quantitative risk analyses on all the loss event scenarios needed to model that risk item. (RiskLens supplies industry standard data that can be enhanced by the client’s data based on its loss events history. The platform also stores scenarios for plug and play.)

- Aggregate the scenarios in an overall risk assessment of probable loss for the register item.

- Pull the risk assessment results back to the risk register to display in the item record.

On a set schedule, RiskLens will automatically update the record with fresh analysis based on latest data. With the risk register/RiskLens integration up and running, clients can stack rank their risk register items by probable loss exposure to the business on an ongoing basis, greatly enhancing the business utility of the GRC or IRM.

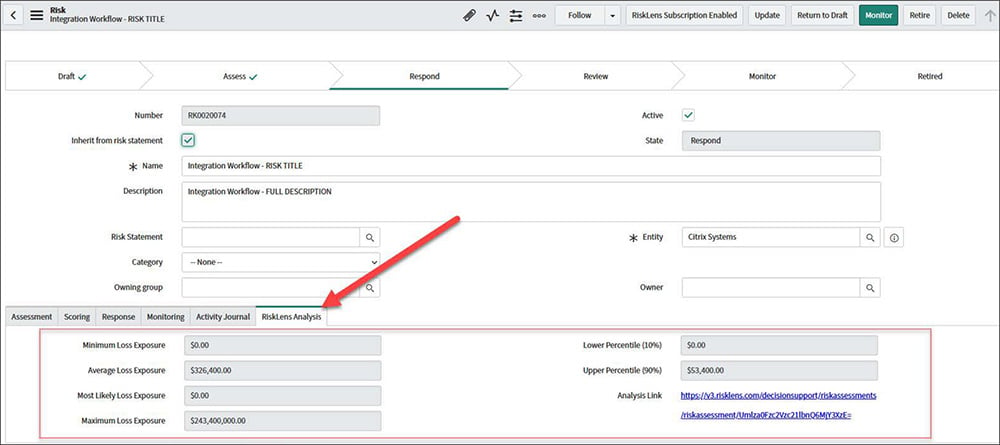

Screenshot of RiskLens Risk Assessment Results on the ServiceNow Platform. Click for larger image.

ServiceNow and RSA Archer have pre-built integrations leveraging the RiskLens APIs, but don’t worry if you’re not a customer of either platform - the integration possibilities are endless with the wide variety of APIs RiskLens offers.

Watch the webinar to learn about all the workflows enabled by RiskLens APIs that can centralize and automate record-keeping for the data that feed your quantitative risk management program.